colorado springs sales tax rate 2019

The latest sales tax rate for Springfield CO. Four states tie for the second-highest statewide rate at 7 percent.

Arizona Sales Tax Rates By City County 2022

The Colorado Springs sales tax rate is.

. This system allows for. 307 Sales and Use Tax Return in Spanish. Average Sales Tax With Local.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Restaurant must charge city tax at the discounted rate for the. 290 State of Colorado.

307 Sales and Use Tax Return. Multiply the sum on line 4 by the tax rate effective for the period of the return. Effective July 1 2022.

Englewood CO Sales Tax Rate. California has the highest state-level sales tax rate at 725 percent. Did South Dakota v.

The GIS not only shows state sales tax information but it also includes sales tax information for counties municipalities and special taxation districts. 010 Trails Open Space and Parks TOPS 040 Public Safety Sales Tax PSST 057 2C Road Tax. Colorado Springs CO Sales Tax Rate.

Line 4 multiplied by 10 X 010 equals Auto Rental Tax due to the City of Colorado Springs. Colorado Springs is located within El Paso County Colorado. Intended to be substituted for the full text within the City of Colorado Springs Tax Code.

Denver CO Sales Tax Rate. The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. 1 2021 the new City of Colorado Springs sales and use tax rate will be 307 for all transactions.

Download and file the Retail Delivery Fee Return DR 1786 to register a Retail Delivery Fee account. COLORADO SPRINGS Colo. The lowest non-zero state-level sales tax is.

Commerce City CO Sales Tax Rate. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Colorado Springs does not currently collect a local sales tax. 123 El Paso County 100 Pikes Peak Rural Transit Authority PPRTA Restricted Use.

The Colorado Springs Sales Tax is collected by the merchant on all qualifying sales made within Colorado Springs. There are a total of 276 local tax jurisdictions across the state collecting an average local tax of 4075. This rate includes any state county city and local sales taxes.

719 385-5291 Email Sales Tax Email Construction Sales Tax. The 1 rate applies to short term less than 30 consecutive days rentals of. The County sales tax rate is.

TOPS PSST 2C Road Tax. The average cumulative sales tax rate in Colorado Springs Colorado is 724. City sales tax collected within this date range will report at 312.

Fort Collins CO Sales Tax Rate. Within Colorado Springs there are around 51 zip codes with the most populous zip code being 80918. Indiana Mississippi Rhode Island and Tennessee.

OBrien Sharon Created Date. Groceries and prescription drugs are exempt from the Colorado sales tax Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax.

4 rows Colorado Springs CO Sales Tax Rate. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8. 307 City of Colorado Springs self-collected 200 General Fund.

The Colorado sales tax rate is currently. The extension is at a reduced tax rate of 057 down from 062. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle to a location in Colorado.

As of November 30 the roughly 166 million in total sales tax revenue measured about 063 percent lower compared to this same point in 2019. The current total local sales tax rate in Colorado. Colorado Springs CO 80903.

January 1 2016 through December 31 2020 will be subject to the previous tax rate of 312. This includes the rates on the state county city and special levels. 5 rows The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. 6 rows The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state. In November 2019 Colorado Springs voters approved a five-year extension of the 2C sales tax that generates revenue specifically for road improvements.

Instructions for City of Colorado Springs Sales andor Use Tax Return. 2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates.

Lowest sales tax 29 Highest sales tax 112 Colorado Sales Tax.

Colorado Sales Tax Rates By City County 2022

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

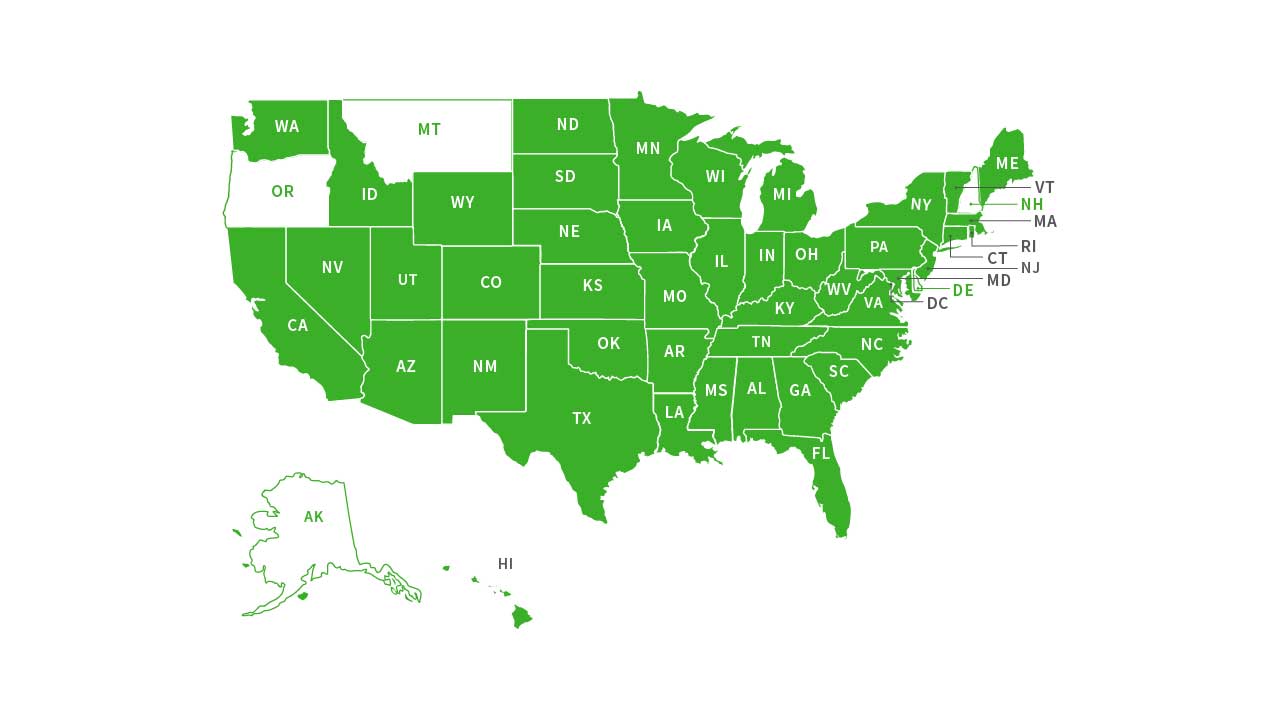

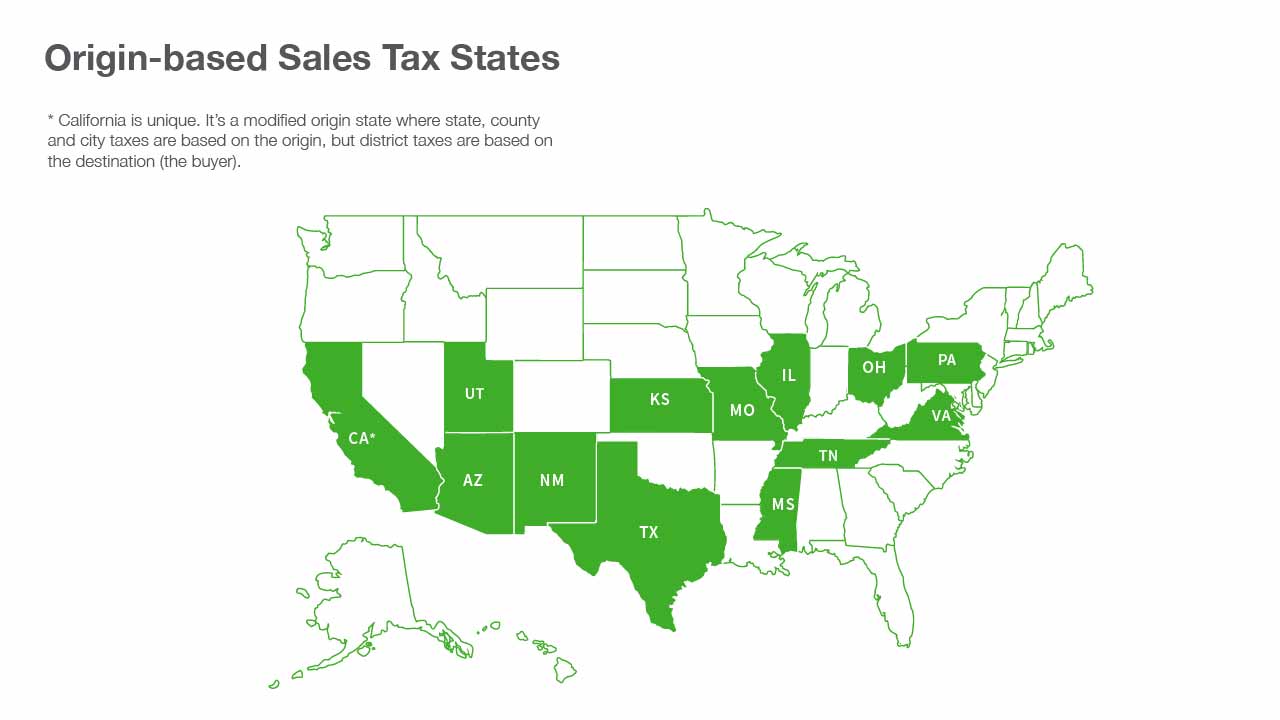

The Consumer S Guide To Sales Tax Taxjar Developers

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

The Consumer S Guide To Sales Tax Taxjar Developers

The Consumer S Guide To Sales Tax Taxjar Developers

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

The Consumer S Guide To Sales Tax Taxjar Developers

California Sales Tax Rates By City County 2022

Florida Sales Tax Rates By City County 2022

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

The Consumer S Guide To Sales Tax Taxjar Developers

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

The Happiest Cities States Countries All In One Map Infographic Elephant Journal No Wonder My So Happy City Happiest Places To Live States In America

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation